Contents

Do not blindly believe what other people tell you, do your own research and build your trading knowledge. The STOCHASTIC indicator shows us information about momentum and trend strength. As we will see shortly, the indicator analyses price movements and tells us how fast and how strong the price moves. The Stochastic Oscillator was developed by George Lane in the 1950’s. Lane believed that his indicator was a good way to measure momentum which is important because changes in momentum precede change in price. In a 2007 interview he was quoted as saying “Stochastics measures the momentum of price. If you visualize a rocket going up in the air – before it can turn down, it must slow down. Momentum always changes direction before price.”.

But often these two terms are used when the random variables are indexed by the integers or an interval of the real line. If the random variables are indexed by the Cartesian plane or some higher-dimensional Euclidean space, then the collection of random variables is usually called a random field instead. The values of a stochastic process are not always numbers and can be vectors or other mathematical objects. As a range-bound indicator, the stochastic oscillator can be used to identify overbought and oversold market conditions.

The models result in probability distributions, which are mathematical functions that show the likelihood of different outcomes. By allowing for random variation in the inputs, stochastic models are used to estimate the probability of various outcomes. Of or pertaining to a process involving a randomly determined sequence of observations each of which is considered as a sample of one element from a probability distribution. Wedge and triangle price forms, as well as trendlines, perform nicely with stochastic indicators. The trader could, for example, use a genuine trend line to monitor an established trend and wait for the price to break the trend with confirmation from the stochastic indicator.

This ensures that we’ve just had a short pullback in a long term positive trend, which makes it likely that the market soon is going to continue making new highs. For instance, if going long on oversold stochastic readings, you may demand that RSI shows oversold readings as well. There are more oscillators out there than just the stochastic indicator. Stochastic doesn’t react to the speed or momentum of a move since it’s only concerned with the relative position of the close to the recent high-low range.

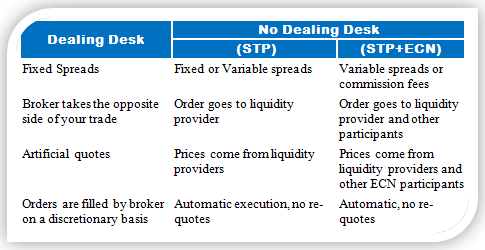

A stochastic oscillator is a momentum indicator comparing a particular closing price of a security to a range of its prices over a certain period of time. The sensitivity of the oscillator to market movements is reducible by adjusting that time period or by taking a moving average of the result. It is used to generate overbought and oversold trading signals, utilizing a 0–100 bounded range of values. The stochastic indicator is drawn three types of account with two lines on the chart; the indicator itself (%K) and a signal line (%D) which represents the 3-day simple moving average of %K. When these two lines cross, traders should look for an approaching trend change. A downward crossing of the %K-line through the signal line indicates that the current closing price is closer to the lowest low of the specified time period of the indicator than it has been in the previous three sessions.

Stochastic divergence strategy

This phrase is used in trading to denote a security’s present price tied to a range of probable outcomes or its price range over a given time period. As you see on the image above, the Stochastic Oscillator gives many signals. However, since the signals anticipate the real event on the chart, the Stochastic Indicator success rate is relatively low. Therefore, you should always combine this indicator with an additional trading tool or trading platform. The reason for this is that the Stochastic is not a good standalone trading indicator in online trading app.

%K, in turn, is a measure of the close price in relation to the high-low range of the last n-bars, as defined by the user. In a trend-following strategy, traders will monitor the stochastic indicator to ensure that it stays crossed in one direction. An important point in relation to the divergence strategy is that trades should not be made https://1investing.in/ until divergence is confirmed by an actual turnaround in the price. An instrument’s price can continue to rise or fall for a long time, even while divergence is occurring. Overbought and oversold levels are useful for predicting trend reversals. A reading above 80 indicates that the instrument is trading near the top of its high-low range.

Types of Stochastic Processes

Discrete-time stochastic processes and continuous-time stochastic processes are the two types of stochastic processes. The continuous-time stochastic processes require more advanced mathematical techniques and knowledge, particularly because the index set is uncountable, discrete-time stochastic processes are considered easier to study. If the index set consists of integers or a subset of them, the stochastic process is also known as a random sequence. If the index set is some interval of the real line, then time is said to be continuous. The two types of stochastic processes are respectively referred to as discrete-time and continuous-time stochastic processes.

The technical analyst should be aware of the overall trend of the market. It would not be unwise to use Stochastic along with other means of technical analysis such as trend lines to confirm the market direction. The stochastic oscillator displays the consistency with which price closes near its recent high or low by comparing the present price to the range across time. The stochastic oscillator is range-bound, which always oscillates between zero and one hundred.

- The Relative Strength Index is a momentum indicator that measures the magnitude of recent price changes to analyze overbought or oversold conditions.

- When we get this signal the price increases.The blue lines on the chart indicate a bullish divergence between price action and the Stochastic Indicator.

- However, the process can be defined more broadly so that its state space is -dimensional Euclidean space.

- By comparing the current price to the range over time, the stochastic oscillator reflects the consistency with which the price closes near its recent high or low.

- In 1925 another French mathematician Paul Lévy published the first probability book that used ideas from measure theory.

Often there are quite a lot of tendencies that lie hidden behind the surface, which could be used to determine if it’s favorable to enter a position or not. Below you see an example where both RSI and Stochastic readings are turning oversold. This certainly can be a disadvantage in quite a lot of situations, where the speed and momentum could provide valuable information about the likelihood of a reversal, just to name one example. This is generally what we want to see, since it indicates that there is plenty of room for the market to move up without becoming too overbought. %K-Line CrossoverAs you might notice, stochastic came from low readings.

Social sciences

This indicates that selling pressure is building, and the price of the instrument may fall. After a brief market comeback, traders frequently try to enter a sell transaction. When the price of an instrument makes a lower low while the stochastic indicator produces a higher low, this is known as a bullish divergence. A divergence approach is another common trading method that uses stochastic indicators. Traders use this method to see if the price of an instrument is making new highs or lows while the stochastic indicator is not. Overbought and oversold readings can be identified using the stochastic indicator.

These are typical levels but may not be suitable for all situations depending on the financial instrument being traded. Finding the correct levels comes with some experimentation as well as historical analysis. Remember, it is typically best to trade along with the trend when using Stochastic to identify overbought/oversold levels. The reason is that overbought does not always mean a bearish move just like oversold does not always mean a bullish move.

Poisson process

A reading below 20 signals that the instrument is trading near the bottom of its high-low range. After you made a strong point about the fallacy of “Overbought” and “Oversold”, you started referring to the above-and-below the line situations as overbought and oversold yourself. I am curious because I looked up the details on modifying the indicator provided by my brokerage firm’s charts, and they refer to it as overbought and oversold also. I have never seen such a wonderful and completely logical explanation of any indicator. More importantly, this article is meant to make you realize how little you might know about the tools you use for your trading. Additionally, there is a lot of wrong knowledge being shared among traders and even widely used tools such as the Stochastic indicator is often misinterpreted by the majority of traders.

Slow Stochastic

When we get this signal the price increases.The blue lines on the chart indicate a bullish divergence between price action and the Stochastic Indicator. A reading above 80 is usually considered as overbought, while a reading below 20 is considered oversold. However, the price can remain in overbought and oversold conditions for a long period of time, especially during strong up- and downtrends.

Volume Indicators: How to Use Volume in Trading – Best Strategies and Analysis (list)

To achieve that, one has to resolve the details, even if these cannot be observed, as that provides a much simpler possibility of analysis. Brownian motion is a typical example of a continuous process of Markov type. If one observes the position and velocity of a Brownian particle at one time, one can predict the future motion. Further information does not provide better prediction possibilities. Note that, however this concerns the observation of both velocity and position.

The random variable typically uses time-series data, which shows differences observed in historical data over time. The final probability distributions result from many stochastic projections that reflect the randomness in the inputs. The relative strength index and the stochastic oscillator are commonly utilized in technical analysis because these are both Price momentum oscillators. The stochastics indicator creates a range with values ranging from 0 to 100. A reading of 80 or higher indicates that a security is overbought and should be sold. Oversold readings of 20 or less are considered a buy signal and is referred to as stochastic trading.