Contents:

Goodwill is an intangible asset that is created by the company over a period of time through creation of brand value, high customer base, good customer relation, intellectual property and good employee relations. Goodwill is calculated by subtracting all assets and liabilities from the “purchase consideration” of the company. In summary, goodwill differs from other assets because it is intangible and based on a business’s reputation, brand recognition, and customer loyalty. Its value is difficult to quantify and is determined by a combination of subjective and objective factors. Goodwill is also unique because it is not amortized over time and requires annual impairment testing.

Staff Accounting Bulletin on Crypto Safeguarding Obligations is Not … – Thomson Reuters Tax & Accounting

Staff Accounting Bulletin on Crypto Safeguarding Obligations is Not ….

Posted: Fri, 11 Nov 2022 08:00:00 GMT [source]

However, some GAAPs, directly recognize this difference in P&L A/c while other may recognize it as a capital gain which will be added to the capital reserve balance. Goodwill is classified as a long-term or noncurrent intangible asset on the balance sheet. Companies in the United States have not been obliged to amortize the reported amount of goodwill since 2001. However, at least once a year, the value of goodwill is subjected to an impairment test. On the other hand, this goodwill is unconnected to a business partnership and cannot be documented on the balance sheet. Goodwill is difficult to measure as it is often considered a residual value, the difference between the purchase price paid for a business and the fair market value of its identifiable assets.

Goodwill

If you have questions about goodwill and goodwill impairment, contact your CPA — he or she can help you better understand these complex factors as you prepare to buy or sell a dealership. A business with a high-risk factor fails to win the trust of the stakeholders, like investors, bankers, lenders, customers, etc. When the risk involved is high, a business firm fails to attain its capital requirements, which in turn hampers the execution of a managerial plan and the profit-making ability of the firm. So, it can be concluded that the higher the risk, the lower the value of goodwill. The development of any business unit depends upon the efficiency of the management.

Impairment of goodwill often signals that the acquisition is not working, and wealth has been destroyed. This creates a mismatch between the reported assets and net incomes of companies that have grown without purchasing other companies, and those that have. In accounting terms, expenses are costs incurred by a business in generating revenue. Goodwill does not meet this definition as it is not directly related to revenue generation. Instead, it is recorded on a company’s balance sheet and reflects the difference between the price paid for an acquisition and the tangible assets acquired.

As discussed earlier, as a result of business combination i.e. an entity buying another entity for a price in excess of fair value of identifiable net assets will give rise to goodwill asset. Different accountants have different debates on how to compute goodwill. This is really needed as mergers take different factors into account, even those that are not visible at the time of the acquisition. This doesn’t seem to be an issue during the acquisition process, since the acquirer has already done his homework on what to pay. However, when goodwill is calculated, this becomes a significant issue as accountants are basically running around trying to calculate the value of both firms that have acquired other firms, and those that haven’t. Goodwill is generally not to be confused with intangible assets as intangible assets have a finite lifetime, while goodwill doesn’t.

Practitioner goodwill refers to goodwill in regard to a specific line of business that is practiced, similar to practice goodwill. But this type of goodwill is focused specifically on the skills, knowledge, and talent of the practitioners. Under the UK GAAP, goodwill has a finite useful life and should therefore be amortised. If a company can’t accurately estimate the goodwill’s useful life, it can’t exceed five years.

Understanding Goodwill Impairment

In addition, private companies can measure impairment at the entity level. So, if you have multiple franchises that are doing well overall but an acquired franchise is underperforming, the modified rules give you extra time to turn things around before reporting an impairment loss. When a partner retires from a firm, his/her share of the goodwill shall be enjoyed by the continuing partners. Now here, the retiring partner shall be the one sacrificing the shares in favour of the continuing partners, who are also the gaining partners. As a result of this, the continuing partners shall pay the compensation to the retiring partner in the proportion of the value of the goodwill of the firm. Hence, the valuation of goodwill becomes necessary in case of the retirement of an old partner.

By analyzing goodwill, managers can identify the strengths and weaknesses of their company and accordingly formulate effective business strategies. Managers of acquiring companies are often incentivized to pay a premium for an acquisition to boost their performance and enhance their reputation. Subjectivity in valuation is one of the principal drawbacks of goodwill. The valuation of goodwill involves a substantial amount of subjective judgment. Determining the fair value of net assets and calculating goodwill requires assumptions and estimates, which can vary depending on the evaluator.

Technically speaking, the rate at which asset is amortized is required to be in line with the rate at which benefits are rendered by the same intangible asset. Speaking of goodwill, it is really hard to value the benefits goodwill generates over a period of time. And due to this amortisation charge cannot be linked to the economic benefits rendered in particular accounting period. Goodwill is considered to be an intangible asset with indefinite life therefore not amortized. However, entities are required to conduct impairment review of goodwill on regular basis without waiting for indicators of impairment. When an organizations buys another organization , it recordsallof the assets and liabilities of purchased organization atfair valueafter identifying each and everyone of them.

goodwill

Here the premium value following the acquisition is $10 billion, and it will be recorded in PB Enterprises balance sheet under the long-term assets account as goodwill. Goodwill can also be recorded when the amount used in purchasing a target company is higher than the debt incurred. Using a real life example, let us consider T-Mobile and Sprints merger in 2018. As at March 31, 2018, using S-4 filing, the deal was valued at $35.85 billion. The fair assets value was $78.34 billion, and the fair value of the firms liabilities was $45.56 billion. In this case, goodwill for this deal was $3.07 billion or basically the different between the assets value and the liabilities value which is $35.85 billion.

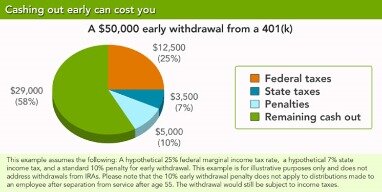

Goodwill impairment equals the excess of the carrying amount of the entity over its fair value. This measurement standard is simpler than GAAP for nonprivate entities, because private businesses aren’t required to hypothetically reallocate fair value to all of the entity’s identifiable assets and liabilities. Let us assume that Company CX assets separate from their liabilities is $20 billion, and a firm, say PB Enterprise acquires Company CX for $30.

For example, In the above example, ABC Co acquired assets for $12 million, where $5 million is from Goodwill. When the market value of assets drops to $6 million, then $6 million (12-6) has to be impaired. Then it is impaired for the entire $5 million, and other assets acquired are proportionately by $1 million. It generally is recorded in the journal books of account only when some consideration in money or money worth is paid for it. We will learn to calculate Goodwill step by step with the help of an example.

- If the value of the goodwill has significantly decreased, the company may be required to take charge of its earnings, which will reduce its reported net.

- But other assets — such as used vehicle inventory, customer lists and franchise agreements — may require outside appraisals.

- A positive reputation attracts customers, investors, and partners, which helps to expand the company’s operations and increase its market share.

- Goodwill can be subject to impairment testing, where the company assesses whether the fair value of the goodwill on its books is still worth the same amount as in the past.

- “Impairment” refers to the fluctuations in a business’s fair market value.

- Here is a list of goodwill impacts on a company’s financial performance.

A business operated under the supervision of efficient managers will earn more profit, and is likely, to enjoy a high value of goodwill in the market. If a manager fails to properly execute the management plans, the financial position of the business is hampered, which ultimately decreases the value of goodwill of the firm. If the business unit is located in the prime market area, then the firm enjoys the attention of more customers, which means more profit.

Understanding Islamic finance: The next frontier in socially responsible investing

Therefore, investors must carefully consider various factors when evaluating the usefulness of goodwill in their investment decisions. Moreover, Goodwill can be subject to impairment testing, which means that companies must regularly evaluate their goodwill for any impairment loss. If there has been a decline in value due to market conditions or other factors, companies must write down the goodwill amount accordingly. Goodwill provides valuable insights into the market perception of a company. It helps managers make informed decisions, such as strategic investments, mergers, or acquisitions.

Concept of negative goodwill is opposite to that of goodwill where companies pay a higher premium than the fair value of the assets. Anybody buying that company would book $10 million in total assets acquired, comprising $1 million physical assets and $9 million in other intangible assets. And any consideration paid in excess of $10 million shall be considered as goodwill. In a private company, goodwill has no predetermined value prior to the acquisition; its magnitude depends on the two other variables by definition.

For instance, a company may offer a valued customer a discount on future purchases if the customer has had a poor experience with the brand. Inherent goodwill is not purchased and results from within the same company. For example, this can result from changes in a company’s reputation, which then increases its value. Peggy James is an expert in accounting, corporate finance, and personal finance. She is a certified public accountant who owns her own accounting firm, where she serves small businesses, nonprofits, solopreneurs, freelancers, and individuals.

Accounting-Based Valuation Approach – GAR

Accounting-Based Valuation Approach.

Posted: Mon, 19 Dec 2022 08:00:00 GMT [source]

When XYZ acquires Widget it will “fair value” all identifiable net assets. That is, it will value acquired assets at their market value, assuming a market exists. Since many assets lack fully functioning markets, fair value is a more technically precise term.

Goodwill is an intangible asset that represents non-physical items that add to a company’s value but can’t be easily identified or valued. Goodwill is an example of an intangible asset that has an indefinite useful life, and is therefore tested for impairment on an annual basis as opposed to being amortized on a straight line basis. Goodwill is technically an intangible asset, but is usually listed separately on a company’s balance sheet.

Business goodwill is generally used in accounting when acquisitions take place, unless the type of business is more specific, such as a practice. Goodwill should always be recorded in a separate line under the assets section of the buyer’s balance sheet; however, the treatment of goodwill varies between different accounting standards. According to both GAAP and IFRS, goodwill is an intangible asset which has an indefinite life. This means that – unlike other intangibles – it doesn’t need to be amortized. However, businesses are required to evaluate goodwill in business for impairment on a yearly basis.

New FASB Crypto Accounting Rules Will Tackle Certain Fungible … – Thomson Reuters Tax & Accounting

New FASB Crypto Accounting Rules Will Tackle Certain Fungible ….

Posted: Wed, 07 Sep 2022 07:00:00 GMT [source]

She has edited thousands of personal budgeting report articles on everything from what happens to debt when you die to the intricacies of down-payment assistance programs. Because goodwill is made up of components with subjective values, there’s always a risk that the purchasing company will overvalue goodwill. If this happens, goodwill should later be written down to reflect a more accurate value. You can now accept JCB card payments with all current models of SumUp card reader. INVESTMENT BANKING RESOURCESLearn the foundation of Investment banking, financial modeling, valuations and more.